Sustainability and AI Business Action Centre is actively participating in designing and delivering training workshops in the field of sustainable finance, climate finance, climate risks, ESG, blended finance and related business sustainability concepts. These workshops are aimed at industry professionals, bankers, and students, across different countries. This includes customization of training content based on the audience profile and objectives. Sample engagements conducted include:

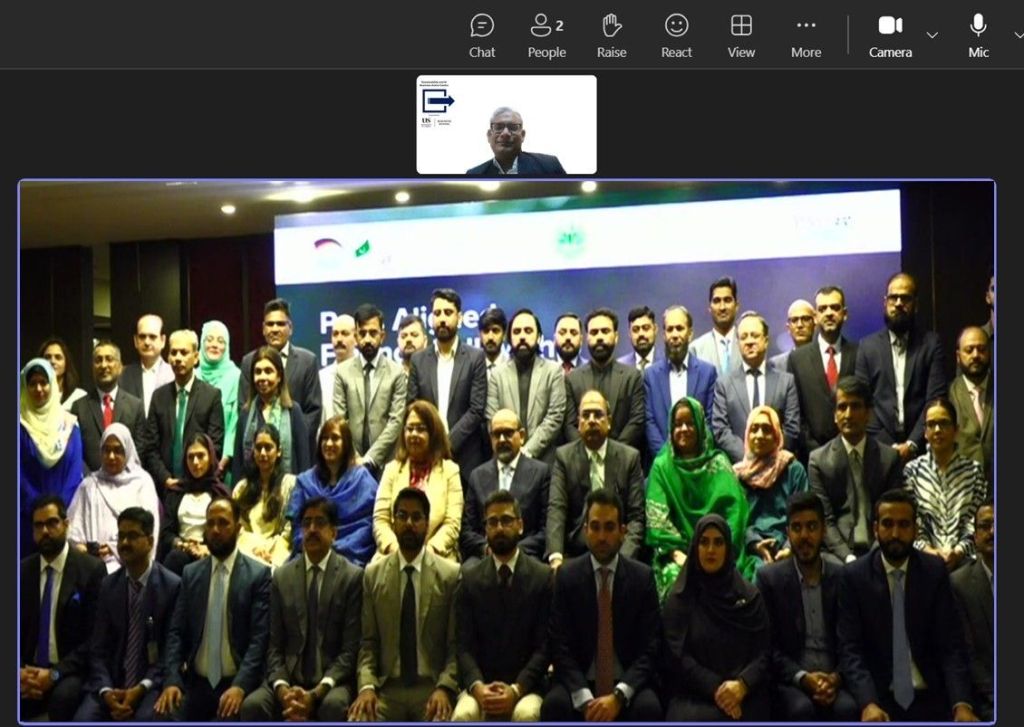

1. GIZ Pakistan’s Paris Fellowship Program in association with the State Bank of Pakistan: Delivered 4 modules on green and transition finance, transmission of climate-related risks and sustainable finance concepts, targeting 50+ senior- and mid-level bankers and regulators from Pakistan.

In addition to virtual training delivery, SABAC also contributed in co-designing the outline of the training workshop, sourcing external speakers from responsible banking and climate risk assessment domains, and co-writing the handbook on Transition Finance that was distributed to participants.

2. Ho Chi Minh University of Banking’s SaigonISB, a part of the central bank of Vietnam (SBV): Delivered an in-person guest-lecture on climate finance and climate risks, targeting 100+ students of banking and finance at HUB Vietnam. The workshop was conducted jointly with auctusESG that delivered a module on examples of banks that have worked in these areas.

3. University of Economics Vietnam’s Sustainable Finance Institute: Delivered an in-person guest-lecture on ESG risk management practices and experiences in Asian banks, targeting 20+ students of corporate sustainability and environmental management at SFI, UEH Vietnam.

4. Chartered Institute for Securities & Investment (CISI)’s Kenya Chapter: Delivered a virtual module on transition finance concept, principles, instruments and business benefits, as part of a Transition Finance Masterclass organized by CISI’s Kenya Chapter, targeting bankers in Kenya and other CISI member countries.